Best YNAB Alternatives: Financial management applications are the order of the day, and YNAB is one option available for users looking for a quality leap in their savings or financial management capacity. If you are looking for an app to optimize your economy, here we will explain how YNAB works and provide other important details such as its operation, security, and similar apps in the service it offers.

What is this application?

If you’re wondering why a financial management application is called YNAB, it stands for “You Need A Budget.” Basically, the existence of this application finds its reason for being there: it was created so that users could manage their money in a more efficient way. Furthermore, it does so with a more analytical aspect than other services.

In the analysis section offered by YNAB, in fact, you can carry out a very detailed study of each of the income and expenses carried out. That, together with the fact that it allows you to link your bank account to have direct access to every movement of your money (but not to deposits or withdrawals), makes YNAB offer a more complete service than much of its competition.

YNAB operation

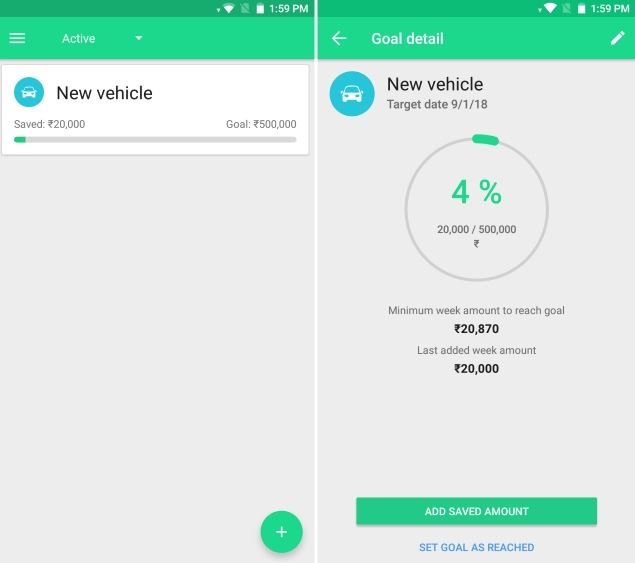

YNAB, like many other services in its commercial space, has an easy and simple operation: save money by giving you a clear breakdown of your income and expenses. In this way, you will be able to detect at which points you are incurring unnecessary expenses and considerably increase your savings margin. In addition, this app has a particularly detailed interface for breaking down information. In fact, this service even allows you to link your bank accounts to make it easier to track income and expenses.

The operation of YNAB may seem more complex than that of other similar services since, at times, it may give the impression that you are in front of an Excel rather than an interface with more visual resources. That makes it have a point in favor and another against: the positive is you will be able to obtain more details of each cent you spend and save. On the negative side, YNAB can overwhelm you more than other financial management apps if you don’t like numbers.

This application has a free and paid version, but the paid version, which costs 70+ USD per year, is more designed for small businesses with a greater volume of income and expenses than for personal use. Therefore, before considering paying for the premium version, it is always advisable to try the free app. In fact, trying other apps in their free version is even advisable if you prefer to avoid taking the step to their paid version.

YNAB offers an interface with many expense details in its version for smartphones

You cannot withdraw money; you only need to check your movements

As in many other financial management services, at YNAB, you will not manage the money directly but monitor it in detail. You will be able to know everything about what you spend and where you allocate your money, but this app will not have access to the savings you have in your bank accounts, and it will not have functions such as blocking operations. If you want to avoid any payment or collection, remember to contact the corresponding banking entity.

Likewise, if what you are looking for, apart from a digital fintech that allows you to monitor your economy, also has a deposit in which to store your money, you will be interested in discovering more about neobanks. Whether with a banking license or as an electronic money institution, you can deposit money and make payments directly from said accounts. This is something very different from the simplicity of banking management apps, but if it is closer to your interests, do not hesitate to consult that option.

Security of this app

This application has bank-level security certifications and 256-bit encryption, guaranteeing that your monetary information will always be safe. In fact, considering that YNAB allows you to consult the data of your bank accounts, adequate security is essential to avoid any data leak. Likewise, there would be no chance of you losing your money since YNAB allows you to review your money but not deposit or withdraw it.

Furthermore, suppose you are not convinced by the idea of allowing YNAB access to your banking transactions. In that case, you can also opt for the simple option of manually entering your income and expenses and managing your finances without needing the application to access your information directly private. It is a safer option but also less comfortable since it involves spending more time manually entering your economic movements.

YNAB Alternatives

I guess a quick glance at this website is enough to guess that I am a full-fledged You Need A Budget (YNAB) ambassador and promoter. I recommend this method and its apps with my eyes closed because I have not found a single person who has not greatly benefited from the YNAB method in all the years I have been advising.

However, I have found cases where some of my clients have preferred another application (usually, people who have been using another solution for years). Although I am convinced that YNAB is the best combination of method and apps to get out of the pot permanently, it is possible (although more difficult) to achieve it using almost any other computer offer. In the Dominican Republic, we say, “he is the Indian, not the arrow.” It’s the user, not the tool, that makes the difference.

The differentiating point of YNAB is that in addition to (or rather, before) the apps called “YNAB,” everything is supported by a methodology, a group of rules, and some healthy habits. That’s why you can use YNAB without YNAB: You can implement the method in almost any app, Excel, or even with a pencil and paper. I don’t earn anything by recommending other solutions (YNAB doesn’t pay me directly for recommending them either), but I want to be honest with you: If you are already a user of another app and you feel comfortable with it, you don’t have to change it. I can teach you how to apply the YNAB method in any app.

By presenting these alternatives to YNAB, I only highlight that there are hundreds of solutions. It is important to rely on one of them and apply the method. I suggest you try as many as you can and make your own judgment. Of the ones I show here, some I have used for a long time, and if YNAB didn’t exist, I would probably still be using them. Almost all of them have trial versions or free plans, but their best features are also paid. And this is a reality: Investing in a personal finance application is not a bad idea. Let us begin!

Goodbudget

This app probably has the best set of features, similar to YNAB. It has apps for iOS and Android, as well as a web app. Like YNAB, Goodbudget is also based on “envelope budgeting”. Users designate “envelopes” or categories to which they allocate money to fund those categories. For the same reason, Goodbudget also recommends the concept of “zero budgeting.”

With its free plan, you can create 10 categories, assign only one account, and synchronize with two devices. The paid version costs $60 per year and removes all limits.

The YNAB method can be implemented in Goodbudget as long as you are willing to do things manually.

Wallet by BudgetBakers

It is also an app present on iOS, Android and the web. Promotes the creation of a “traditional budget” and assigning categories for expenses. It has an excellent focus on reporting and its information dashboard is one of the most complete and useful I have seen recently. It has an annual cost of 21 dollars, but I have seen promotions where they give you a lifetime subscription for the same amount.

I don’t think applying the YNAB method in this app is that easy, since Wallet doesn’t force you to budget at zero, but it can be used in that direction if you put enough effort into it.

financial.io

With this service you can manage all your finances completely free and with total privacy, since all the data you enter will be exclusively in your browser. The disadvantage of this is obvious: you can only use your budget on one device and on a specific browser.

The developer offers a synchronization service ($12 per year) that will allow you to use your data on all the devices you want. Financier.io does not have mobile apps, but it can be used with your cell phone browser. If you want to use this app long-term, you should consider paying for synchronization to avoid a headache.

Other similer apps

- Mint: Well-known and highly recommended, developed by Intuit, one of the companies with the longest history in this field. Mint, however, only seems to be really useful in the United States and Canada. I haven’t gotten much use out of it, but it seems more oriented to recording expenses.

- Quicken: The veteran of personal finance. Intuit is highly known and created, although, in recent times, it seems to have lost its preponderance at the turn of the millennium. It continues to be an excellent tool, very complete and versatile, but in my opinion, it is not easy to use. She has very varied plans, with Simplifi being the web + mobile version of her.

- Everydollar: A concept more oriented towards transaction registration than budgeting, but with a service that can be used in Latin America. It was created by Dave Ramsey’s company, which has its own personal finance method.

- Toshl: For my taste, it is the most “fun” app in this section. A good balance between budgeting and transaction recording.

And these are just a handful of applications. If you search on Google or your mobile app store, you will find literally thousands of apps.

Pick your weapon

As I said at the beginning, the important thing is that you realize the many existing solutions. I believe that to get out of the pot you will need one (or perhaps several) apps, since its advantages are obvious and convenience is necessary when you must look for what best suits your lifestyle.

I only hope that you explore, educate yourself, watch app tutorials, and choose something that you like and that is similar to you. Although the ways will vary, you can apply the rules of the YNAB method to any you choose.

Read Also: